Do you find your business growing but your profits lagging behind? Are you working harder and harder each month to make ends meet? I’m here to tell you there’s a better way. There is a new money management system where you can put profit first. When you make this shift, you (and your yoga business) become stronger, more confident, and sure-footed in your growth over time. Plus, you can then serve your clients from a place of greater alignment and ease.

Do you find your business growing but your profits lagging behind? Are you working harder and harder each month to make ends meet? I’m here to tell you there’s a better way. There is a new money management system where you can put profit first. When you make this shift, you (and your yoga business) become stronger, more confident, and sure-footed in your growth over time. Plus, you can then serve your clients from a place of greater alignment and ease.

Sound too good to be true?

Well, years of experience and implementation by Michael Michalowiz prove otherwise. I recently listened to an interview with him on one of my favorite business podcasts. He shows you how to flip your money mindset to make steady growth possible for your business. And, he’s helped thousands of business owners achieve financial success using this simple formula.

I will warn you, this system challenges much of the accounting tactics used in most small businesses. Since I like a challenge, I implemented the Profit First format myself.

Low and behold, it really is easy to use, and I save so much time and energy each month by using this simple approach to managing money. The process has me so excited that I wanted to share it with you now. This blog post is an overview of the Profit First formula. Then, if you find it as valuable as I do, you can get the Profit First Book that has more details about how to get started in your own yoga business moving forward.

Alright, let’s dive in!

Photo Credit: Sharon McCutcheon

SHIFT YOUR MONEY MINDSET

To run a yoga business, you put in a lot of hard work. You invest in yourself with your time, energy, sweat, and tears. All of this dedication and expertise is then passed on to your clients in a compassionate way. As a yoga professional, you hold the space for the hopes and dreams of your students. You see their potential, and you encourage them to achieve it.

Because of the spiritual nature of this business, many think that caring and customer service trumps the importance of money. Financial growth can become less of a priority, and money management can get placed on the backburner. This results in stress and a weakened ability to serve your clients well. As one of my favorite quotes points out,

“It’s hard to be a light to the world if you can’t pay your light bill.”

To increase your positive impact in the world, it’s essential to shift your mindset about money. This involves acknowledging (and believing) statements like:

- Money is a tool that creates possibilities for myself and others.

- Money is a resource that can amplify who I am–my passions, my skills, and my spirituality.

- I enjoy making lots of money.

- Money helps me fully realize my authentic self, and it can definitely be a powerful force for good in my yoga business.

My approach to finances sure changed once I embraced beliefs like these. I used to avoid bookkeeping like the plague, and I’d find any sort of distraction to replace my need to update Quickbooks.

Like many of you, I’m a one-person show, so the work still has to get done. Only now, I have a sweet system in place that rewards my abundance mindset. And, I actually get excited about the work because the Profit First system is easy to use (and I actually see positive progress in my business each time I review the numbers).

Photo Credit: Ember and Earth

LET’S BE CLEAR ABOUT PROFIT

Shifting your mindset about money also requires a clear definition of profit. To your accountant, profit looks like a number on a spreadsheet. This figure is derived from the classic formula:

Income (Sales) – Expense = Profit

But the profit you see on paper might not actually exist in your bank account. You might have already spent that money elsewhere. Since an arbitrary number on a spreadsheet is less tangible, Michalowicz offers a new definition of profit that is far more relevant: “Profit is cash in the bank. Cold. Hard, Cash. For you!”

Profit is real, physical money that you can use to give yourself a bonus for all of that hard work you do. If you don’t see this cash in your business currently, there’s a simple explanation.

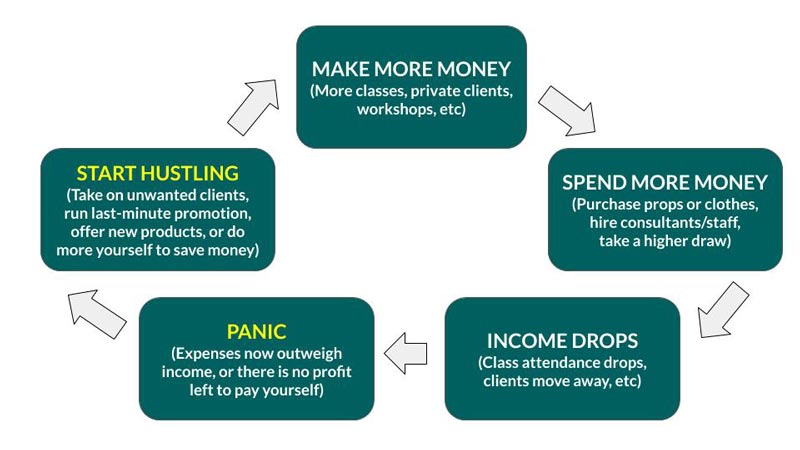

WHY MONEY PROBLEMS OCCUR

Many businesses–even those in the multi-million dollar realm, are not necessarily profitable. They are living month-to-month, barely using their monthly revenue to cover expenses. Or worse, they could be accumulating debt to fund their enterprise.

There are two main reasons why this occurs:

(1) Sales are low.

This can refer to small sales amounts when you are first starting a yoga business, or if your sales fall to a lower than normal level. This can occur when your clientele decreases, a high-paying client moves away, or even if you have to move to a new location.

(2) Sales increase.

While you might think that more sales is automatically a good thing, studies show that as revenue increases in a business, that expenses often swell, too. On a simple level, you see more cash coming into your yoga business, so you spend more money. You buy those additional props you wanted to add to the space. Or you go on a shopping spree to Lululemon or Prana because you’ve been dying to update your wardrobe.

The problem with this scenario is that sooner or later, there will be a slow in sales again (See #1). If this happens, and you’ve already spent your cash reserve, you will try and work harder to make up the difference. Only this amplifies your stress and doesn’t guarantee you’ll actually be left with any real profit.

THE OUTDATED ACCOUNTING SYSTEM

This panic cycle is generated by an outdated approach to accounting which follows the formula mentioned above:

Income (Sales) – Expense = Profit

This formula requires you to sell a whole bunch, teach until your eyes bleed, and use your hard-earned cash to pay the bills before you pay yourself. While this might sound like a smart thing to do, often times there is no profit left over to pay yourself (or create a cushion for your business).

Said another way, this accounting formula insists you place yourself at the bottom of your priority list. Thankfully, the Profit First system helps you change that around.

THE PROFIT FIRST FORMULA

The Profit First formula is just as simple as the outdated one above. Only it’s a more realistic way for you to track your cash flow. And, in a matter of seconds, you can assess the true health of your business and make smarter financial decisions. The Profit First formula is this:

Income (Sales) – Profit = Expenses

This is what the “pay yourself first” concept is all about. You set aside money for yourself and your business before you pay expenses and bills. This starts with:

Step 1: Create an Income account.

Most people have their income and expenses muddled into one account. When you create a separate account designed only to collect income, you can see exactly how much money you are bringing in each month.

Step 2: Set aside your profit first

Before you do anything else with your revenue, Michalowicz says to set aside a percentage or your income as profit. You can see my percentages in the image below, but the Profit First book has lots of other options to fit your own unique business needs.

Step 3: Pay yourself a proper salary

Many entrepreneurs pay themselves a meager salary out of their remaining profit (if there was any profit at all). And if you had to hire someone to do the work that you are, you’d have to pay them properly to keep them around. So take a percentage of your income next and pay yourself a salary.

Step 4: Set aside money for taxes

Instead of freaking out at the amount of money you owe the government at tax time, set aside a percentage of your income each month into a separate tax account. Then, when your quarterly taxes or annual taxes come due, you can pay them without breaking a sweat.

Step 5: Discover your expense budget

Once you have allocated money for the above three categories, you can take a realistic look at how much money you have available to spend on your business. You can then be more resourceful with that budget. And, you can grow in an organic, healthy, and sustainable way.

The Profit First Benefits

When you implement the above steps, the following benefits occur:

- You are guaranteed to get paid

- A financial buffer is created should sales drop or the economy takes a downward shift

- You reinforce the belief you deserve to get paid well.

- Confidence grows in your ability to run a successful yoga business.

- Financial stress is minimized

- You to have more time, energy, and resources to better serve all of your clients.

WHY PROFIT FIRST WORKS

The main reason that the Profit First formula works is that acknowledges that humans are both emotional and illogical. And despite our differences, there are a few commonalities among our species. The Profit first system builds on those natural tendencies to help you achieve financial success.

To understand why this system works, you have to think of money like food.

(1) You Consume what You’re Served

As a human, you will consume money in the same way you would food. If you have more on your plate, you’ll eat more. If you have more money in your bank account, you’ll spend more. Not sure about this fact? Just check the consumer reports on the growing obesity epidemic or the stats on business failure due to misappropriation of funds.

Since the Profit First formula removes profit before arriving at expenses, you will have less money to operate your business. It’s just like an employee who has their 401K removed from their pay before receiving a paycheck. They simply adjust the amount of money they spend each month to fit that new, lower number. You can easily do the same in your yoga business.

(2) The Order of Priorities Matter

(2) The Order of Priorities Matter

This is called the primacy effect. It essentially states that we, as humans, place a higher priority on whatever we encounter first. Just like if we eat nutrient-dense foods first, our diet and bodies will be more in balance than if we were to eat dessert before dinner.

In the outdated accounting model, sales and expenses come first. This often leads to way too much work on your part just to pay your bills. Again, this gets you stuck in that panic cycle mentioned earlier. When you put profit first, you start to reinforce in your mind (and your yoga business) that healthy, sustainable growth is your highest priority.

(3) Remove Temptation

If you talk to anyone trying to alter their diet for the better, all junk food gets removed from the house and banned from the grocery list. By removing the temptation to binge on the chips or cookies or ice cream close by, you will opt for healthier options when you’re hungry.

The same goes for money habits. When you set aside profit for your yoga business first, and place it out of reach, you won’t spend it unnecessarily. Instead, you’ll find a way to be resourceful and work within the budget you actually have to run your yoga business.

(4) Rhythms establish consistency

When I worked in an office, I would pack snacks and lunch each day. This way, I would eat healthily and consistently. If I forgot my food, I’d often skip meals and end up hangry by the end of the day. Then I’d binge eat everything in sight when I got home. Does this starve and stuff cycle sound familiar to you?

Just as a body digests and processes your food much more efficiently when you eat consistently, your financial health does too.

The best way to do this establish a cash management rhythm. This will prevent you from getting emotionally attached to large deposits or panicked in the face of dips. It can also ward off reactive, unjustified spending. My rhythm is to schedule bookkeeping twice per month, on the 10th and 25th, just as Michalowicz recommends. But you could find a different cycle that works for you. Just make sure to create one to save time and energy!

Photo Credit: Edgar Castrejon

PUTTING IT TOGETHER

Money is one of the best tools you have to actualize your potential and serve others in an incredible way. Instead of drastically changing who you are to manage that money well you can take small steps to drastically increase your financial success. The Profit First formula does just that. It ensures you get paid well for what you do. You learn to do more with less. And, you can establish a healthy, financially stable yoga business starting right now!

Steps to Take Action Now

- Listen to the Profit First Podcast

- Take the free Instant Business Assessment to check your current financial health

- Decide if implementing the Profit First system is right for you. There are more details in the Profit First Book and lots of free resources on Mike Michalowicz’s website.

Leave A Comment